Design note 4 - what do we mean?

In addition to the similarities between our new icon and the real Northern Lights, we particularly liked some of the themes the Northern Lights icon represented, namely:

In addition to the similarities between our new icon and the real Northern Lights, we particularly liked some of the themes the Northern Lights icon represented, namely:

To complement our dynamic new Northern Lights icon, we needed a strong colour pallette and confident, contemporary font.

The contrasting yet complimentary colours in our logo symbolises our value of diversity and unity. We often talk about 'the same but different' at Beckfoot Trust to acknowledge that whilst we have a very clear One Trust identity and clarity on what remarkable means, we also know that one size does not always fit all.

Perhaps the most important part of our new Beckfoot Trust logo is the icon, shown to the right here.

We call it our Northern Lights.

In nature, the Northern Lights are seen as something unique and truly Remarkable that are associated with the North.

Our Northern Lights icon represents The Beckfoot Trust which is also on a constant journey to Remarkable and is strongly associated with the North of England.

As part of our ongoing Journey to Remarkable we felt it was important to give The Beckfoot Trust a strong, confident and contemporary logo and brand that was worthy of an organisation with such high standards and aspirations.

The new Trust logo was a departure from the previous logo style and was definitely designed with the future in mind.

Effective risk management is a crucial tool in achieving the mission of the Trust to ‘create remarkable schools where no child is left behind.’ It is fundamental to every aspect of running our Trust and the schools within it and it is central to keeping children safe, improving attainment and all outcomes, working effectively with colleagues, ensuring financial sustainability, and managing the physical environment. Risk management takes place at all levels of the organisation and is inherent in all decision-making and in the day-to-day operation and the strategic management of our Trust.

The Trust Board are accountable for risk management and for ensuring that there is a sound system of internal control that supports the achievement of policies aims and objectives, whilst safeguarding public funds and assets for which it is responsible.

2.1 This policy sets out how Beckfoot Trust manages risk in a balanced and objective way to allow appropriate control as well as the flexibility to allow intelligent opportunity-taking to further the objectives of the Trust.

The policy explains how the risk register is created and how the Trust uses the risk register to identify, measure, manage, monitor, and report risk. It explains the key roles and responsibilities in relation to risk and sets out how the Board ensures appropriate oversight of risk.

2.2 Linked documents

The objectives for manging risk across the Trust are:

4.1.1 Identify

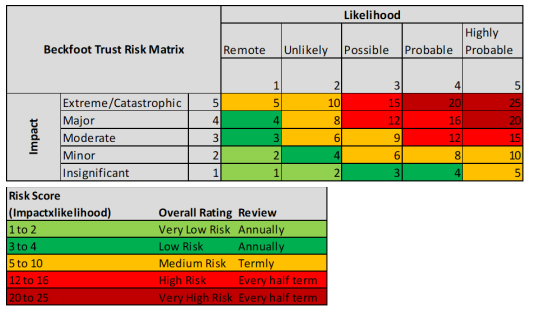

Risks are all potential events that are a threat to the safety of individuals and/or the achievement of the Trusts objectives. Risk management is informally considered with every decision. The Executive Leadership Team formally reviews the risk register, at least once a half-term. Risks are framed in the context of the Trust’s Corporate strategy and risks identified on the individual school risk registers. All risks are categorised using the below table.

Headteachers review their own risk register termly and in relation to the Trust risk register. This is considered in Executive Headteacher line-management meetings and training is provided annually from the internal auditors and other specialist providers in relation to specific risks that need to be managed on an ongoing basis. The specific school risk register may or may not inform the trust risk register and vice versa.

| Category | Definition |

| Governance | Risks related to the direction and control of the Trust |

| Educational | Risks related to the educational outcomes |

| Safeguarding | Risks related to the safety of pupils |

| Financial | Risks to the financial stability and sustainability of the Trust |

| Operational | Risks to the day to day running of the Trust |

| External | Risks external to the Trust that pose a threat |

| Compliance with law and regulation | Risks created by compliance issues |

| Strategic | Inherent risk in Trust wide decision making |

| Reputational | Risk to the reputation of the Trust |

4.1.2 Measure

To understand each specific risk and allow for prioritisation, each one is assessed according to its likelihood and the impact if it did occur. The descriptors of impact and likelihood are detailed in Appendix 1. Once impact and likelihood are determined, the risk is then given an overall risk score by calculating Impact x Likelihood. The score then determines how actively the risk is reviewed according to the below table.

4.1.3 Manage

Once the risk is identified and understood, action is determined. The action will consider:

The following are the actions which may be taken:

| Action | Explanation |

| Tolerate | No action taken Controls not deemed cost effective Risk impact so low it is considered acceptable |

| Treat | Control measures put in place to minimise likelihood of occurrence or of impact Potential identification of contingency measures in case of occurrence Demonstrable assurance identified in controlling the risk Risk re-assessed for residual risk score and rating |

| Transfer | Risk transferred to third party Usually via insurance or payment Risk re-assessed for residual risk score and rating |

| Terminate | Remove the risk Effective where there is no material effect on operations Considered when risk is highly ranked and other actions are impractical or too expensive Risk re-assessed for residual risk score and rating |

| Take Advantage | Considered when potential benefits of intelligent risk taking outweigh the potential negatives Intelligent risk taking may strategically advantage the Trust |

4.1.4 Monitoring

Monitoring of risks is ongoing and continuous and provides assurance on the extent to which the actions and controls are working as intended and whether risks are managed to an acceptable level. The Trust Risk Register is the tool which allows effective monitoring of risk.

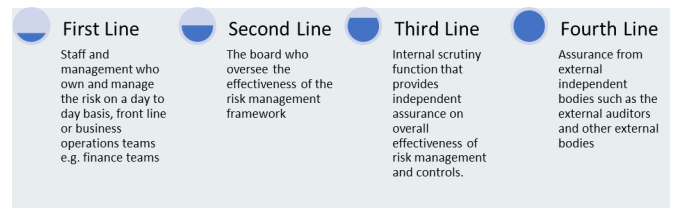

The executive leadership team are responsible for monitoring risk and the risk owner is responsible for providing appropriate assurance to the board that the risk is well-managed. Assurance may be provided in diverse ways depending on the level of the risk, the higher the risk the more likely it is that a higher level of assurance is needed.

4.1.4 Reporting and Review

The risk register is reviewed by the Audit and Risk committee three times a year and is recommended for approval to the Trust Board as set out in the Scheme of Delegation. The review process is flexible and, in all cases, allows for targeted focus on the highest priority risks.

4.2.1 Trust Board

4.2.2 Audit and Risk Committee

4.2.3 CEO/Accounting Officer

4.2.4 DCEO/Deputy Chief Executive Officer

4.2.5 Executive Leadership Team

4.2.6 Headteachers

4.2.7 Person Accountable for Named Risk (e.g. Cluster Business Managers or DCEO)

4.2.8 Risk and Compliance Manager

This policy is reviewed and amended annually.

| Likelihood Descriptor | Score | Example |

| Remote | 1 | May only occur in exceptional circumstances |

| Unlikely | 2 | Expected to occur in a few circumstances |

| Possible | 3 | Expected to occur in some circumstances |

| Probable | 4 | Expected to occur in many circumstances |

| Highly Probable | 5 | Expected to occur frequently in most circumstances |

| Impact Descriptor | Score | Impact on Trust |

| Insignificant | 1 | No Impact on service No Impact on reputation Complaint unlikely Litigation risk remote |

| Minor | 2 | Slight impact on service Slight impact on reputation Complaint possible Litigation possible |

| Moderate | 3 | Some service disruption Potential for adverse publicity – avoidable with careful handling Complaint probable Litigation probable |

| Major | 4 | Service disrupted Adverse publicity not avoidable Complaint probable Litigation probable |

| Extreme/Catastrophic | 5 | Service interrupted for significant time Major adverse publicity not avoidable (National media) Major litigation expected Resignation of senior management and board Loss of stakeholder confidence |